FintechZoom.com positions itself as a global finance news platform covering markets, cryptocurrency, fintech innovation, and investment trends. The key question for readers is not simply what it covers—but how it fits into the modern financial information ecosystem.

Why FintechZoom Matters in Today’s Financial Ecosystem

In a world where markets move in seconds and crypto trades 24/7, access to timely, simplified, and aggregated financial information is no longer optional—it’s essential. This is where platforms like FintechZoom matter.

| Factor | Why It Matters | Impact on Financial Ecosystem |

| Accessibility of Financial Information | Provides free, easily accessible financial news and market updates online | Democratizes financial knowledge for retail investors |

| Real-Time Market Coverage | Covers stocks, crypto, fintech, commodities, and economic trends | Helps readers stay informed about fast-moving markets |

| SEO-Driven Financial Content | Publishes topic-specific, search-optimized articles | Captures high-intent users searching for financial insights |

| Focus on Emerging Sectors | Covers fintech, blockchain, AI finance, digital banking | Highlights innovation shaping modern finance |

| Retail Investor Targeting | Simplifies complex financial topics | Bridges gap between institutional data and everyday investors |

| Aggregation & Analysis | Combines news summaries with analysis | Saves time for readers needing quick financial insights |

| Global Financial Coverage | Covers US, global markets, crypto, and fintech trends | Expands financial awareness beyond regional markets |

| Digital-First Publishing Model | Operates fully online without legacy print constraints | Adapts quickly to trending financial topics |

| Alternative to Tier-1 Media | Offers finance content outside traditional outlets like Bloomberg or Reuters | Provides diversified perspectives in financial media |

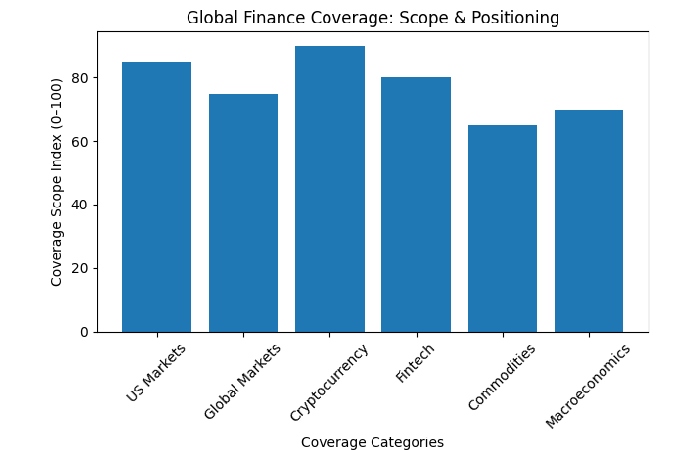

Global Finance Coverage: Scope & Positioning

Global finance reporting typically includes:

- Central bank policy updates

- International economic indicators

- Cross-border fintech developments

- Global capital market shifts

Platforms such as Reuters and Bloomberg maintain international service and correspondents. Digital-first platforms like FintechZoom generally curate and abridge global trends rather than produce original on-the-ground reporting.

Observed Coverage Themes

FintechZoom frequently publishes on:

- U.S. Federal Reserve updates

- European economic movements

- Cryptocurrency market cycles

- Tech-sector financial developments

FintechZoom Coverage Depth Comparison

| Feature | Institutional Media (Reuters/Bloomberg) | Digital Finance Platforms |

| On-the-ground reporting | Yes | Limited |

| Direct government source interviews | Yes | Rare |

| Trend summarization | Yes | Yes |

| Speed of trend coverage | Moderate | High |

FintechZoom appears to align more closely with the digital trend-reporting model.

Markets Coverage: Stocks, Indices & Macro Trends

Market reporting generally falls into three categories:

- Real-time reporting (earnings, breaking macro news)

- Analytical commentary (sector outlooks, performance)

- Educational investment content

FintechZoom appears to focus primarily on:

- Stock performance abstract

- Sector-based investment themes

- Macro-manage market narratives

Example Coverage Patterns

Typical topics include:

- S&P 500 movements

- AI-related stock momentum

- Inflation impact on equities

- Banking sector developments

However, compared to institutional outlets:

- Deep earnings-call transcripts are less common.

- Advanced valuation modeling is typically absent.

- Investigative financial reporting is limited.

FintechZoom Cryptocurrency Coverage: Volume & Trend

Crypto coverage is often a traffic driver in digital finance publishing.

FintechZoom appears to cover:

- Bitcoin and Ethereum price movements

- Altcoin volatility

- Regulatory developments

- Blockchain innovation

Crypto reporting varies significantly in quality across the web. Reliable reporting references:

- Exchange liquidity data

- Regulatory statements (SEC, FCA, ESMA)

- On-chain metrics

- Verified company announcements

Crypto Reporting Risk Model

High Volatility → Fast Publishing → Headline Amplification → Retail Reaction

Because crypto markets move rapidly, digital platforms often prioritize speed.

Readers should verify claims using:

- Official exchange data

- Regulatory announcements

Institutional research notes

Investment Content: Educational vs Advisory

Investment content typically falls into:

- Informational guidance

- Strategy explanations

- Regulated advisory recommendations

FintechZoom appears to publish informational content rather than regulated financial advice.

Financial journalism ≠ licensed investment advisory services.

In the U.S., regulated advisors operate under SEC or FINRA oversight. In the EU, financial advisory services fall under ESMA and national regulators. FintechZoom does not present itself as operating under these regulatory frameworks.

Business Model & Monetization Structure

Most digital finance platforms generate revenue through:

- Display advertising

- Programmatic ad networks

- Affiliate marketing partnerships

- Sponsored content

If content is free to access and subscription tiers are not visible, the likely revenue model is traffic-based monetization.

FintechZoom Monetization Comparison

| Revenue Model | FintechZoom (Likely) | Bloomberg | Wall Street Journal |

| Subscription | Not clearly visible | Yes | Yes |

| Ads | Yes | Limited | Limited |

| Institutional Data Services | No | Yes | Yes |

| Premium Analytics | Not visible | Yes | Yes |

This distinction affects content structure and publishing speed.

Geographic Reach & Audience Positioning

FintechZoom appears to target a global audience:

- U.S. retail investors

- International crypto enthusiasts

- Fintech industry followers

Unlike regionally regulated financial firms, it does not appear to position itself as operating under a specific financial authority.

Geographic Content Spread

| Region | Coverage Type | Frequency |

| U.S. | Stocks, Fed updates | High |

| Europe | Macro & fintech trends | Moderate |

| Asia | Market movements | Variable |

| Global Crypto | Price & regulation | High |

This indicates broad topical reach rather than regulatory jurisdiction-based operation.

Comparative Positioning in the Financial Media Ecosystem

| S.no | Category | Examples | Editorial Structure | Revenue Model | Institutional Oversight | Primary Strength | Typical Limitations |

| 1 | Institutional Global News | Reuters, Bloomberg, Financial Times | Full newsroom with editors, correspondents, legal review | Subscriptions, enterprise data services, limited ads | High (global regulatory exposure, corporate governance) | Deep investigative reporting, primary data sourcing | Expensive access, slower publishing cycle |

| 2 | Large Digital Financial Media | Yahoo Finance, MarketWatch, CNBC | Structured editorial teams, mix of reporting & commentary | Ads + subscriptions (some premium tiers) | Moderate to High | Broad market coverage, accessible analysis | Less investigative depth than Tier 1 |

| 3 | Digital Finance Publishing Platforms | Independent finance sites, SEO-driven financial content hubs (e.g., FintechZoom) | Lean editorial structure, content-focused publishing model | Primarily ad-supported | Limited visible institutional oversight |

How Readers Should Approach It

If you use FintechZoom for global finance news:

- Treat it as a secondary information layer.

- Verify stock data via SEC filings or company investor relations pages.

- Confirm macroeconomic data with Federal Reserve or European Central Bank releases.

- Cross-check crypto developments with official regulatory statements.

Diversifying information sources reduces decision risk.

Conclusion

FintechZoom.com functions as a global digital finance news platform covering markets, crypto, fintech, and investment topics. Its positioning aligns more with fast-moving digital publishing than with institutional financial journalism.